In Gaza, cash has become so scarce that desperate residents now lose nearly half their money to brokers just to access their own funds, while humanitarian aid and economic survival slip further out of reach with each passing day.

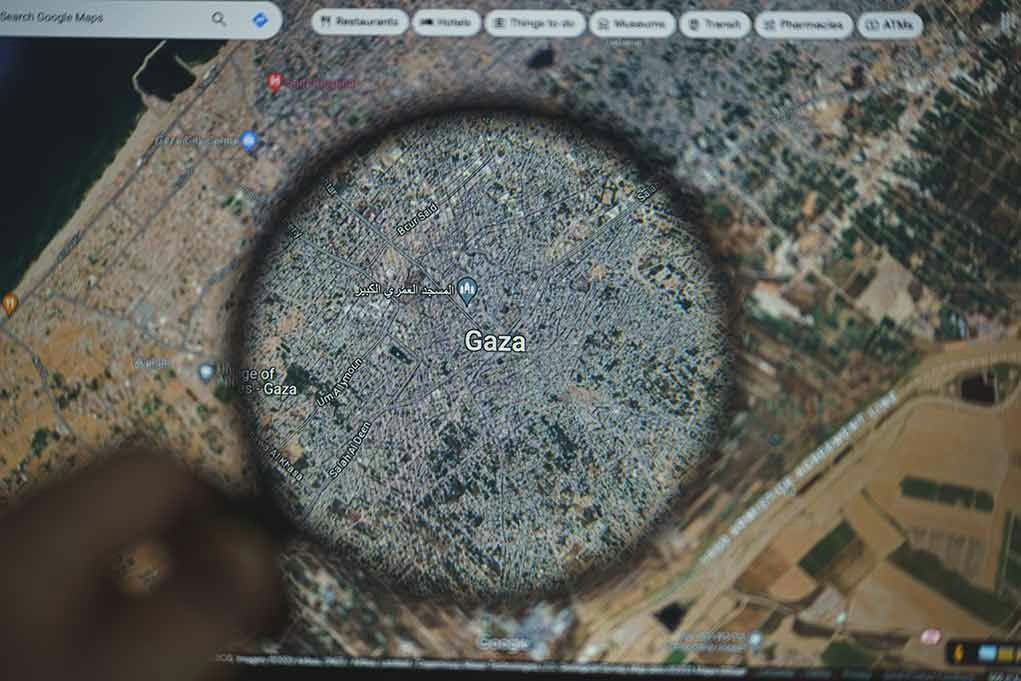

Currency Scarcity in Gaza: When Money Turns to Dust

Gaza’s war-torn economy has collapsed into a cash-starved wasteland, where even the battered Israeli shekel—once the lifeblood of daily commerce—has become a luxury. Since Israel slammed the border shut on new cash shipments in October 2023, the territory’s banks and ATMs have been reduced to rubble. The few remaining, battered bills in circulation are so worn out that merchants now refuse to accept anything but the crispest notes, fueling a bizarre new industry: money repair shops that tape, iron, and patch up mutilated cash so it can be spent at all.

The result? Ordinary Palestinians suffer a Kafkaesque ordeal just to buy bread or medicine. With almost no cash left, the only way to access funds trapped in frozen bank accounts is to pay a so-called “cash broker”—an informal operator who, for a staggering 40% commission, will hand over banknotes in exchange for an electronic transfer. It’s legalized extortion, and civilians have no choice but to comply. This is what happens when government and international “experts” insist on digital solutions in a place where there’s no electricity, no trust, and no functioning market.

Brokers, Black Markets, and the Collapse of Order

Before the war, Gaza’s banking system was already fragile, with less than 100 ATMs serving more than two million people. But after the October 2023 assault, the last vestiges of formal finance simply evaporated. Israel’s blockade slammed the door on new currency, and with no central bank of its own, Gaza was left to wither. Desperate civilians watched as their savings became worthless numbers on a screen, while aid workers, shopkeepers, and even the few remaining business owners joined the hunt for real, tangible cash.

Israel is the evil pic.twitter.com/9DBlbXcnHo

— Muhammad in Gaza🇵🇸⚡️ (@7MohammedKhaled) July 11, 2025

The power vacuum was instantly exploited. Cash brokers—some with ties to deep-pocketed traders and, allegedly, even criminal syndicates—stepped in to fill the void. What began as a 5% commission for cash withdrawals at the start of the conflict ballooned to 40% by mid-2025. This “tax” is now the cost of survival. Meanwhile, digital payment schemes like Iburaq fizzled, as merchants and customers alike demanded cash, not promises. In this chaos, the black market reigns supreme, and the Palestinian Monetary Authority is powerless to intervene.

The Human Toll: Hunger, Inflation, and the Death of Dignity

With unemployment soaring to 80% and food prices up 5,000%, daily survival has become a grim lottery. Most jobs that still exist pay wages via direct deposit, but without physical cash, these deposits are little more than cruel jokes. Humanitarian aid—already a lifeline for most families—now loses nearly half its value to broker fees before it even reaches those in need. Aid workers themselves are forced to pay the same ransom to brokers, eroding their own ability to help others.

I’ll never forget when Justin Bieber posted “Praying for Israel” with a photo of Gaza being destroyed on his Insta story, then deleted it and posted ”Praying for Israel” without the image. pic.twitter.com/olpHAf8ZHT

— Omar El Fares 🇵🇸 عُمَر الفارس (@3lfares) July 10, 2025

Every layer of society is spiraling downward. Small businesses collapse as suppliers refuse worn-out bills, and the few groceries that remain open can’t restock shelves without pristine cash. Ordinary families are forced to sell their last possessions at fire-sale prices, just to buy a few loaves of bread. The so-called “money repair” shops are the final insult—a patchwork economy for a population abandoned by both its leaders and the international community. No one, it seems, is willing to step in and restore basic economic order. And so, the suffering continues, with no end in sight.

Sources:

Charity & Security Network: Gaza Liquidity Crisis

The New Humanitarian: Cash became a commodity