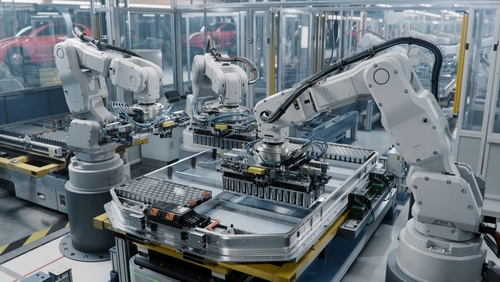

The Trump administration is poised to revise the U.S. CHIPS Act, which could significantly reshape the semiconductor industry and the nation’s security framework. This strategic reconfiguration has raised questions about the administration’s ultimate objectives and impact on the sector.

Renegotiation of CHIPS Act Awards

The Trump administration has implemented a new strategy to renegotiate the awards associated with the CHIPS Act, impacting semiconductor funding. This move focuses on reinvigorating the U.S.’s competitive edge and strengthening national security. However, such renegotiations entail temporary funding delays, affecting the progress of semiconductor projects and research initiatives nationwide. Companies and research institutions are now recalibrating their expectations to synchronize with the administration’s redefined priorities.

The White House is renegotiating U.S. CHIPS Act awards and delaying some semiconductor funding disbursements under a review by the new Trump administration, according to sources.

The 2022 law, aimed at boosting domestic chip production with 39 billion in subsidies, is being… pic.twitter.com/vqmSEqFQAV

— Barrett (@BarrettYouTube) February 14, 2025

Trump’s administration acknowledges the pivotal role semiconductors play in national security. Accordingly, these recalibrations in funding aim to align with a strategic national vision. Such decisions mark a definitive pivot from the previous administration’s policies, emphasizing a more aggressive stance on bolstering domestic chip manufacturing against global competitors, especially China.

Political and Financial Repercussions

Despite early campaign critiques against the CHIPS Act, Trump will unlikely roll back the legislation. The Act, signed in August 2022, provides nearly $53 billion for domestic semiconductor manufacturing. It was a contentious point during the election cycle. Trump’s administration is anticipated to keep most of the Act intact while potentially adjusting fund allocation. Analysts say this careful balancing act indicates bipartisan support for advanced manufacturing onshore.

THE TRUMP TRADE: PART DEUX

There are several sectors that are unambiguous winners in a Trump admin (noted below).

There are still a bunch of open questions.

If you have an informed view on these you have an edge.

Healthcare Policy:

Will supplemental subsidies (e.g.,… https://t.co/bAFmvhMXJ9

— Ram Ahluwalia CFA, Lumida (@ramahluwalia) November 9, 2024

“We put up billions of dollars for rich companies to come in and borrow the money and build chip companies here, and they’re not going to give us the good companies anyway.” – Donald Trump.

Asian companies, such as TSMC and Samsung, have already been offered significant funding to establish U.S. facilities. Meanwhile, Commerce Secretary Gina Raimondo’s goal for the U.S. to produce a fifth of the world’s advanced logic chips by 2030 might require another CHIPS Act tranche. Yet experts speculate that Trump’s government might hesitate to endorse a second iteration.

Challenges Ahead

CHIPS Act funding delays risk undermining America’s position in the global semiconductor race. The administration’s initiative to reevaluate fund distribution underscores the complexities of adjusting the nation’s semiconductor policy. The delays and financial inefficiencies add to the historical disadvantage the U.S. has experienced compared to other countries offering more substantial subsidies.

A nuanced approach is critical, as chip manufacturing is capital-intensive, necessitating significant government and industry investment to foster a competitive edge. Therefore, the administration continues to dialogue with industry stakeholders to refine its policy execution, balancing national security interests with the need for a robust domestic tech sector.

Sources:

https://www.csis.org/analysis/trumps-moves-modernize-us-technology-policy

https://www.newsmax.com/newsfront/chips-act-trump/2025/02/13/id/1199021